trust capital gains tax rate uk

The capital gains tax would then be due via Self Assessment. If they turn around and sell the house for its 200000 value but you only paid 50000 for the property way back when they must report and pay tax on a 1500000 capital gain the.

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

You can get Capital Gains Tax relief on 50 of the investment up to 100000.

. The IRS allows 250000 of tax-free profit on a primary residenceWhat this means in a simplified sense is if you bought your primary residence for 300000 in 2010 lived in it for 8 years and then sold it in 2018 for 550000 you wouldnt have to pay any capital gains tax. Instead of taxing it at your regular income tax rate they tax it at the lower long-term capital gains tax rate 15 for most Americans. You can claim a foreign tax credit on your US return for the Canadian taxes paid and so your US capital gains tax of 52000 should be reduced to 0 after the.

There are several ways in which you can avoid capital gains tax. Main residence exemption allows homeowners to avoid paying capital gains tax if their property is their principal place of residence PPOR. There is more information on GOVUK about the records the personal representative will need for the trust and estate tax return and about how to pay any CGT liability elsewhere on GOVUK.

This manual is to help people compute chargeable gains and allowable losses for both capital gains tax and corporation tax purposes or check computations. Fortunately when you inherit real estate the propertys tax basis is stepped up which means the value is re-adjusted to its current market value and often reduces or entirely eliminates the capital gains tax owed by the beneficiaryFor example Sallys parents purchased a house years ago for 100000 and bequeathed the property to Sally. If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of tax.

If your income falls in the 40400441450 range your capital gains tax rate as a single person is 15 in 2021. Australia maintains a relatively low tax burden in. Gains from selling other assets are charged at 10 for.

You do not have to sell an asset before you invest. A CGT liability may arise. For example if your completion date for a property disposal is 28 March 2022 then provided you file your Self Assessment tax return for 202122 including the disposal by 27 May 2022 then you will not usually need to file a 60-day return or pay the capital gains tax within 60 days.

Avoiding Capital Gains Tax. The Government has introduced new reporting requirements for UK. Here are the long-term capital gains tax brackets for 2020 and 2021.

Im a real and legit sugar momma and here for all babies progress that is why they call me sugarmomma progress I will bless my babies with 2000 as a first payment and 1000 as a weekly allowance every Thursday and each start today and get paid. The income range rises slightly to the 41675459750 range for 2022. Long-term capital gains tax is a tax applied to assets held for more than a year.

The calculation of tax is based on the net gain realised on sale with the rate of tax being 20 for most assets. Capital gains tax rates for 2022-23 and 2021-22. For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0.

Long-term capital gains tax rates typically apply if you owned the asset for more than a year. It supplements the basic guidance in. Capital Gains rates will not change for 2020 but the brackets for the rates will change.

Capital Gains Tax on Rental Property VS. The maximum amount you can get is 50000. The US capital gains tax rate is as high as 20.

The rate of tax on chargeable capital gains on disposals by the estate of chargeable assets other than residential property is 20. Income taxes are the most significant form of taxation in Australia and collected by the federal government through the Australian Taxation OfficeAustralian GST revenue is collected by the Federal government and then paid to the states under a distribution formula determined by the Commonwealth Grants Commission. Avoiding a capital gains tax on your primary residence You can sell your primary residence and avoid paying capital gains taxes on the first 250000 if your tax-filing status is single and up to.

Most taxpayers pay a maximum 15 rate but a 20 tax rate applies if your taxable income exceeds the. The rates are much less. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest profits on the sale of a home.

Capital gains tax CGT is a tax that arises when a person disposes of an asset and makes a profit that is capital in nature. The 1012 Tax Bracket. Therefore a capital gain of 260000 480000 selling price less 220000 cost will result in US capital gains taxes of 52000.

The capital gains tax property six-year rule see below. When you own an asset for more than a year and sell it for a profit the IRS classifies that income as a long-term capital gain. What If the Recipient Sells the Property.

The first one is main residence exemption. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the. We would like to show you a description here but the site wont allow us.

Many people qualify for a 0 tax rate. The rates are much less onerous. Your child inherits your tax basisbasically what you paid for the propertywhen you transfer it to them as a gift during your lifetime.

The long-term capital gains tax rates are 0 percent 15 percent and 20 percent depending on your income.

Capital Gains Tax On Shares Everything You Need To Know Box Advisory Services

Capital Gains Tax Examples Low Incomes Tax Reform Group

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

What Is Investment Income Definition Types And Tax Treatments

How To Tax Capital Without Hurting Investment The Economist

Capital Gains Tax 30 Day Rule Bed And Breakfast

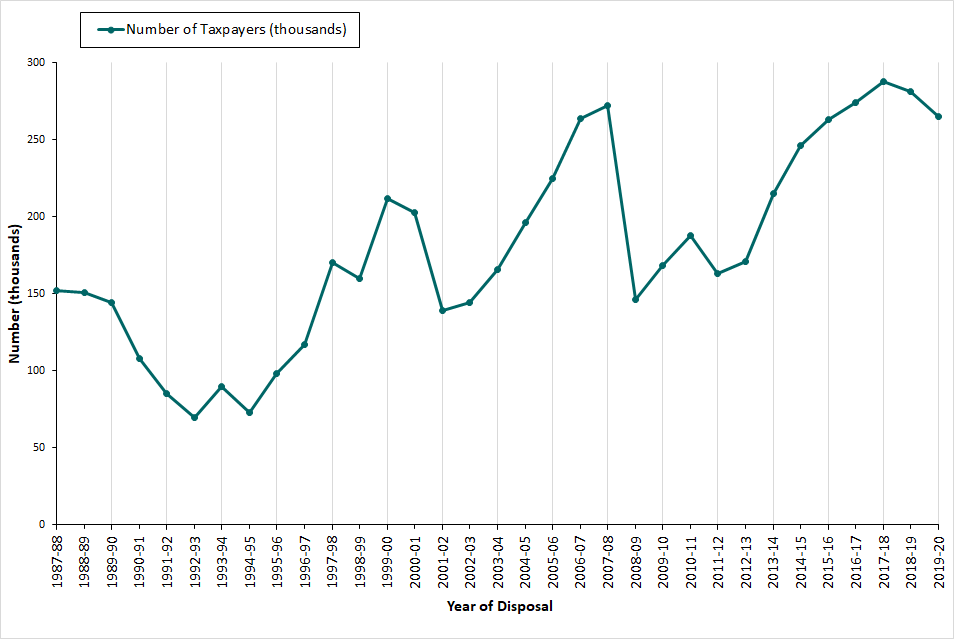

Capital Gains Tax Commentary Gov Uk

Capital Gains Tax What Is It When Do You Pay It

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Capital Gains Tax What It Is How It Works What To Avoid

Capital Gains Tax Commentary Gov Uk

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

Selling An Inherited Property And Capital Gains Tax Yopa Homeowners Hub

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

The States With The Highest Capital Gains Tax Rates The Motley Fool

What Is Capital Gains Tax And When Are You Exempt Thestreet