colorado springs vehicle sales tax rate

Multiply the vehicle price after trade-ins but before incentives by the sales tax fee. Colorado collects a 29 state sales tax rate on the purchase of all vehicles.

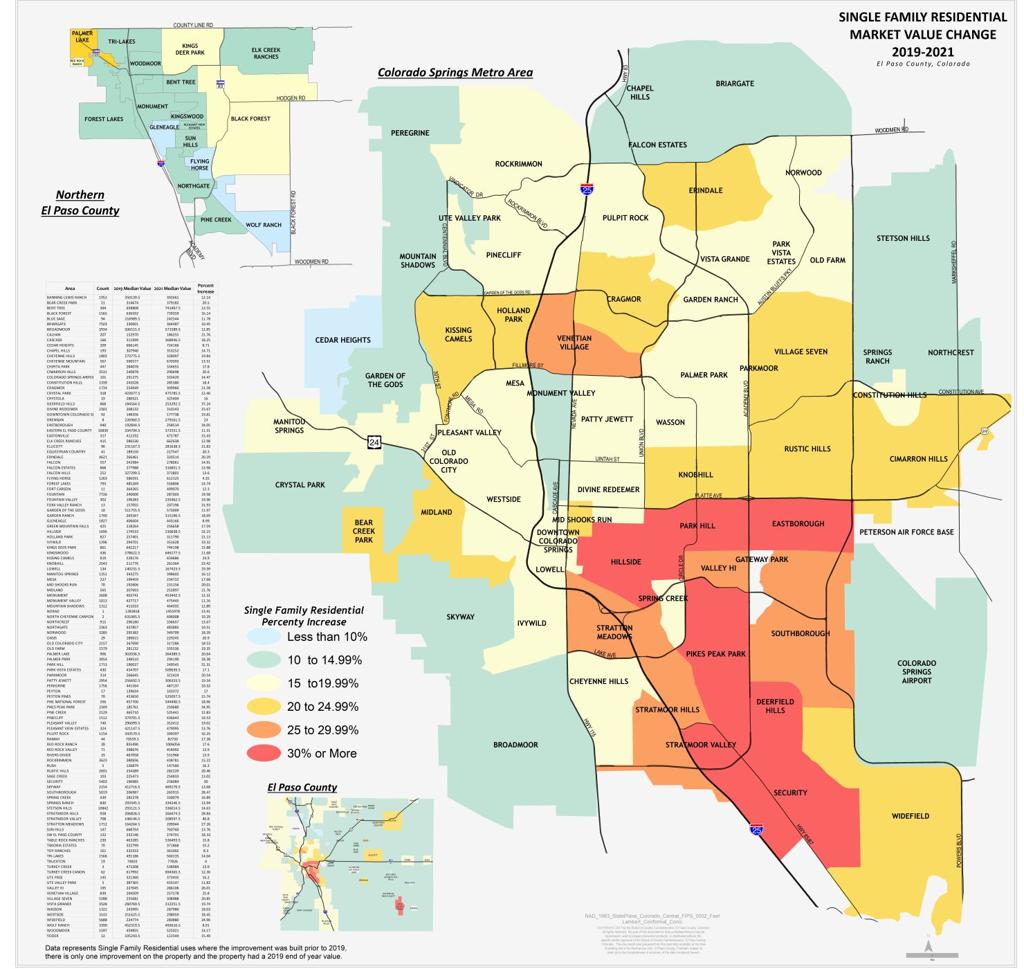

Increased Tax Bills Expected For Most El Paso County Property Owners Assessor Says News Gazette Com

This is the estimated.

. The current total local sales tax rate in Colorado Springs CO is 8200. To calculate the sales tax on your vehicle find the total sales tax fee for the city. Specific Ownership Tax Class Tables- Tax Class.

Rates include state county and city taxes. This is true for Kias and Ferraris and everything in between. Sales Tax for Vehicle Sales DR 0024 Form After completing this course you will be able to do the following.

DR 0800 - Use the DR 0800 to look up local jurisdiction codes. The maximum tax that can be owed is 525 dollars. Owners may be subject to a different tax rate if the vehicle was purchased within the entity where they reside Fountain Manitou Springs or Monument.

2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. Ownership tax is in lieu of personal property tax. The vehicle is principally operated and maintained in Colorado Springs.

The County sales tax rate is. Vehicles do not need to be operated in order to be assessed this tax. The combined amount is 820 broken out as follows.

Commerce City CO. A Colorado Springs resident owns a home in the C ity and a ranch in the mountains. Colorado Springs in Colorado has a tax rate of 825 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Colorado Springs totaling 535.

The 2018 United States Supreme Court decision in South Dakota v. To review the rules in Colorado visit our state. Colorado Springs CO Sales Tax Rate.

In Colorado localities are allowed to collect local sales taxes of up to 420 in addition to the Colorado state sales tax. Two services are available in Revenue Online. You can print a 82 sales tax table here.

2020 rates included for use while preparing your income tax deduction. Columbine Valley CO Sales Tax Rate. Sales Tax Rates in Revenue Online.

Find both under Additional Services View Sales Rates and Taxes. The Colorado Springs sales tax rate is. The El Paso County sales tax rate is.

The Colorado state sales tax rate is currently. For years five through nine the rate is 45 percent. The minimum is 29.

The following table is intended to provide basic information regarding the collection of sales and use tax and reflects rates currently in effect. Licensed retailers can find rate and jurisdiction code information for. DR 0100 - Learn how to fill out the Retail Sales Tax Return DR 0100.

The Colorado Springs sales tax rate is. On November 3 2015 Colorado Springs voters approved a sales and use tax rate increase of 062 to fund road repair maintenance and improvements. When purchasing a new car the individual p roperly paid city sales tax to the dealer and registered h.

The latest sales tax rates for cities starting with A in Colorado CO state. The maximum tax that can be owed is 525 dollars. Although the taxes charged vary according to location the taxes include Colorado state tax RTD tax and city tax.

The Colorado sales tax Service Fee rate also known as the Vendors Fee is 00333 333. The 82 sales tax rate in colorado springs consists of 29 colorado state sales tax 123 el paso county sales tax 307 colorado springs tax and 1 special tax. The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales taxesThe local sales tax consists of a 123 county sales tax a 312 city sales tax and a 100 special district sales tax used to fund transportation districts local attractions etc.

4 rows The current total local sales tax rate in Colorado Springs CO is 8200. Colorado Springs Sales Tax Rates for 2022. Background - Understand the importance of properly completing the DR 0024 form.

Did South Dakota v. View Business Location Rates. Localities that may impose additional sales taxes include counties cities and special.

In addition to taxes car purchases in Colorado may be subject to other fees like. However a county tax of up to 5 and a city or local tax of up to 8 can also be applicable in addition to the state sales tax. City of Colorado Springs Sales and Use tax rate is 307 city collected State of Colorado 29 El Paso County Rate is 123 PPRTA Rate is 10 all 3 entities state collected 513.

The Colorado Springs Sales Tax is collected by the merchant. You can find more tax rates and allowances for Colorado Springs and Colorado in the 2022 Colorado Tax Tables. This is the total of state county and city sales tax rates.

The county sales tax rate is 075. How to Calculate Colorado Sales Tax on a Car. Has impacted many state nexus laws and sales tax collection requirements.

Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction. The tax is a key revenue source funding more than half of the city. After that the tax is fixed at 3.

The Colorado sales tax rate is currently. Of the forty-five states and the District of Columbia with a statewide sales tax Colorados 29 percent rate is the lowest. What is the sales tax rate in Colorado Springs Colorado.

Bank Lock Box Payments. To find out your auto sales tax take the sales price of your vehicle and calculate 772 percent of this price. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is.

This is the total of state and county sales tax rates. What is the City sales or use tax rate. To cite an example the total sales tax charged for residents of Denver amounts to 772 percent.

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. Sales Tax City of Colorado Springs Department 2408 Denver Colorado 80256-0001. This service provides tax rates for all Colorado cities and counties.

View Local Sales Tax Rates. The Index measures the state and local sales tax rate in each state. For tax rates in other cities see Colorado sales taxes by city and county.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. The ownership tax rate is assessed on the original taxable value and year of service. Columbine CO Sales Tax Rate.

Box 15819 Colorado Springs CO 80935-5819. The December 2020 total local sales tax rate was 8250.

Sales Tax Information Colorado Springs

Sales Taxes In The United States Wikiwand

Sales Tax Information Colorado Springs

How Colorado Taxes Work Auto Dealers Dealr Tax

Sales Tax Information Colorado Springs

Health Insurance Tax Health Insurance Infographic Infographic Health Health Insurance

Pin By Alicia Hunt On Budgeting Tax Prep Tax Prep Checklist Small Business Tax

Layers Of Taxation Factor Into Colorado Vehicle Purchases Business Gazette Com

Used Car Dealer In Colorado Springs Co 80909 Drivetime

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

How Colorado Taxes Work Auto Dealers Dealr Tax

Arkansas Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Tax Information Colorado Springs

Income Tax Prep Checklist Free Printable Checklist Tax Prep Checklist Tax Prep Business Tax Deductions

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Colorado Springs Sales Tax Revenue Growth Slowing But Still Strong Business Gazette Com